In many ways, 2021 was a formative year for Contour, as we put in place the pieces we needed for exponential growth going forward. Now, in 2022, we believe Contour will prove to be the common decentralised network that the trade finance industry needs as a foundation for future progress.

We expect our volumes for traditional products such as letters of credit and guarantees will surpass SWIFT’s volumes in five to ten years, eventually replacing the need for SWIFT messages to be used for trade finance at all. This is a lofty goal, but the time and conditions for it to happen are right. Trade is only a small percentage of SWIFT’s volumes, and historically it has not received the attention and resources it requires to solve long-standing issues with poor user experience, the use of paper-based documents, and the trade finance gap.

With a common and dedicated decentralised network developed by Contour and many other partners worldwide, there will finally be the explosion of new value-added products, processes and solutions that trade needs.

Scaling our network

To accomplish our goals, we will need to expand our network and the attractiveness of our offering while lowering the barriers to adoption so that the scale tips towards adoption for even those who trade less frequently or have lower ticket sizes. Traditionally, we have been very successful with banks and corporates eager to digitise and with budgets ready to support those journeys. Many digital platforms are only ever successful with this audience, but this is not our objective.

This is not to say these anchor participants are not important, as they are indeed crucial to the journey. We are working with these leaders and innovators to provide enough incentives and benefits to onboard their networks so that each new member of our network introduces their network and so on. This is what will lead to our exponential growth.

Our key focus in 2022

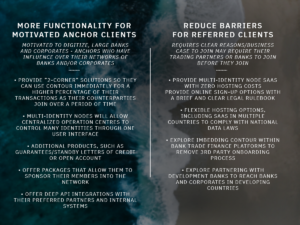

To help achieve this, there will be two areas of focus for Contour in 2022: providing more benefits for motivated anchors and lowering the barriers to entry for those referred clients.

To improve the benefits for motivated clients, we will start to provide more functionality from the moment they join. The first step will be to support transactions between only two or three participants. For example, a large buyer will be able to join our network and start using Contour for submitting Letter of Credit (LC) applications to their banking partners already in the network. As their suppliers (the beneficiaries) join, then they can start working with them using co-drafting, and as the beneficiaries’ banks join, then all the functionalities will be available.

We also want to support more than just LCs. We are currently assessing two major new product expansions. One is open account under the ICC’s new trade rules for digital transactions (URDTT), which would support trade loans, receivables finance and supply chain on Contour. The other is guarantees and standby LCs, which would support a number of use cases, including performance guarantees, financial guarantees, and credit guarantees from development banks. Which product comes first will depend on the outcomes of our lab project and your input, but we are excited to start this expansion.

Continuing to provide value

We want to lower barriers as much as possible for companies being referred to Contour, while we build value over time. It is an unfortunate truth that there are relatively low benefits for new joiners in the early stages of a network’s growth, especially if they are less frequent traders, so we need to match the value with the costs of joining.

Barriers to entry go beyond cost and include processes like legal document signing, onboarding, and IT reviews – all areas where we are making significant improvements.

Contour: A simple SaaS solution

We are continuing to simplify the perceived complexity of decentralised technology with our hosted option, enabling companies to onboard within hours, assess us like any other SaaS solution and have the confidence in our highly secure offering whilst meeting their own data residency requirements.

Our upcoming “multi-identity” solution, which enables a single secure instance (“node”) to represent multiple parties, will create additional opportunities and further reduce costs for our users.

We will also continue to optimise our onboarding processes, agreements, and service models in order to support industry adoption at scale, leveraging new and existing partnerships such as the one with the Global Legal Entity Identifier Foundation (GLEIF) to adopt the globally recognised “legal entity identifier” or LEI as our primary identifier within the application.

By getting this equation right, we will become an easy choice for thousands of corporates around the world to maximise their digital investment.

To recap, 2022 will build on the many successes of 2021. We will focus on scaling at pace, ensuring the “network effect” enhances the benefits of our members whilst reducing cost and increasing efficiency. Our journey to be the trusted network for global trade is well underway. Come and join us.

Contact us to learn how you can start your digital trade journey today.